Download Upload Format - Oracle Documentation

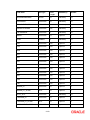

Transcript