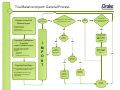

Download Drake Software User`s Manual

Transcript