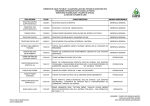

Download User Manual - Supernova Consulting

Transcript