Download COMTRACK PHYSICAL DELIVERY GUIDE V 1.2 14

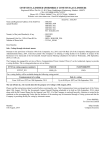

Transcript