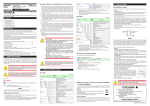

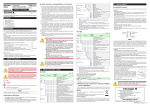

Download Operating Manual

Transcript